COTA- 5th Essay Competition

Click play to listen to the CARICOM Essay competition advertisement.

May 1, 2017 (Nassau, Bahamas) – The Department of Inland Revenue in conjunction with the Caribbean Community Secretariat – CARICOM presents The Caribbean Organization of Tax Administrators 5th Annual Essay competition. This competition is opened to ALL Junior & Senior High schools across The Bahamas. Each competing school may submit a maximum of three essays written by students across grades 9 to 11, ages 14 to 15.

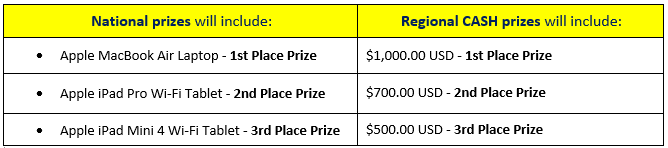

Three national winners will be chosen and these winning essays will be entered to compete against other CARICOM Member States at the regional level.

Entry forms may be obtained from participating schools and should be emailed along with essays to dircomms@bahamas.gov.bs. at the Department of Inland Revenue no later than 5:00 p.m. May 15, 2017.

Please contact your school for further competition details.

Click here to download the news article