File/Pay On-Time to Avoid VAT Fines and Penalties

December 16th, 2015 (Nassau, Bahamas) – The Department of Inland Revenue reminds taxpayers that VAT returns and payments must be received within 28 days after the end of each tax period. Ensure that Value Added Tax (VAT) returns are filed and paid on time to avoid facing fines and/penalties.

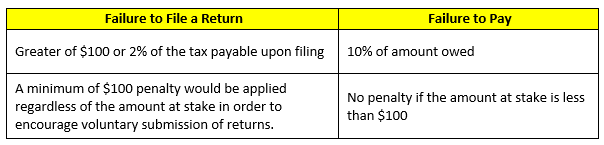

Fines and penalties are automatically generated in the taxpayer’s account by the Online Tax Administration System (OTAS) when timely filing/returns and payments are not made. Fines and penalties for late filing/return and payments are as follows:

- A $100 penalty will apply to credit returns that are filed late.

- Failure to file a VAT return and make payment, are both very serious violations which, under the VAT Act and Regulations carry administrative fines of up to $150,000.

Administrative Fines can be found in section 16 of the Act and Section 44 of the VAT Regulations.

For further information, visit the Department of Inland Revenue’s new website at

www.inlandrevenue.finance.gov.bs, email: taxinquiries@bahamas.gov.bs or call (242) 461-8050.